What I learned this year is that it’s almost impossible to prepare for disaster after it strikes. I also learned how living with the goal of FIRE for the last three years prepared me exceptionally well for the pandemic. Even if you don’t have a desire to retire early, you should make striving for the first half of FIRE (Financial Independence) a way of life for you and your family.

This is more or less what the financial situation of someone practicing FIRE looks like:

- A fully funded emergency fund. That is 6-12 months of your monthly expenses sitting liquid, in a high-yield savings account, just in-case you need it.

- Access to less liquid investments that are outside of retirement accounts, such as stocks and bonds, held in a taxable brokerage account.

- Credit cards that are paid in full every month (zero balance)

- Multiple streams of income both active and passive (and always looking to add more)

Because it rains on everyone here is what I believe would happens in a FIRE seeker’s household if they suffer a job loss:

- Lost Job! Assess the situation, $1,000 a month from the 9-5 job, need $900 to survive each month.

- Check Personal Capital and balance of all accounts. (you already check your net worth every day but this is not a drill)

- File for unemployment, done. Receive $300/month

- Check passive income, stop dividend reinvestments and collect interest from savings, which will bring in $200/month

- Step up the freelancing and/or a part-time job that you already have, which could be another $250/month

- Spending is already in check and no credit card debt

- Feeling good, and you got $750 of the $900 needed each month. Will only need to withdraw $150 each month from the emergency savings account which, is no less than $6,000 and could be as high as $12,000

- Netflix and Chill because all is good in the FIRE household.

While this was meant to be a bit humorous. The truth is individuals seeking Financial Independence with the option to Retire Early work diligently to create multiple streams of money they can tap while they wait for penalty-free access to their retirement accounts. This is usually in the form of a taxable brokerage account and they are often working to have no fewer than two to three years of living expenses to protect against having to sell stock during a down market. They really do have it all figured out. Most FIRE seekers don’t carry credit card debt because it is a pocket-draining, vicious cycle of debt that only serves to delay the FIRE they desperately, desire.

Personally, I look to FIRE as a solution to what ails so many living in poverty, debt and on the edge, even if that edge has a two-car garage and an Audi parked inside.

Criticized by many, members of the FIRE movement are labeled cheap, obsessed and deprived. I speak for myself when I say this couldn’t be any further from the truth. When I first started on my FIRE journey, I did have credit card debt and for a year. I chose to sacrifice a lot to get out of debt as quickly as possible.Today, I no longer have to sacrifice anything. I buy whatever I want for myself (within reason) and I’m able to comfortably do great things for friends and family.

Doing everything through the lens of FIRE created a ripple effect and literally improved the quality of my life. I can’t think of a downside to the FIRE movement. The only outcome you should expect, if you try, is watching your net worth grow rapidly, having more options in every area of your life and being extremely prepared for whatever the future may hold.

New Year Goals?

The Year 2020 was a crazy! I spent July, August and September working to eliminate all the new bad habits the COVID lifestyle created (eating all day, staying up late, not working on a schedule, not working out and binge-watching everything on every streaming service).

I put myself on a strict schedule in November and by January 1, 2021, it should be a solid habit. My new schedule starts at 5:45 a.m. and includes working out, reading, writing, work, break, work, work, house chores and going to bed early. I also have a new planner and this one has stickers! I’ll reward myself with a sticker if I achieve my weekly goals. I happen to be strangely motivated by stickers.

I don’t feel the need to write down weight loss goals, reading a certain number of books or even financial goals. I just want to strive for superior habits that will ultimately generate the results I want.

The plan for me in 2021 is to treat myself the way I strive to treat others. That is, with patience and kindness because 2020 was so traumatizing.

Yes, I’m still goal oriented and I have things I want to accomplish and I have written them down. However, there will be no strict to-do lists, there will be no more burning the midnight oil, there will be no anxiety because I’m not where I hoped to be by March. I will work within the schedule I created for myself and be off work the same way I was off, when there was an office to go to.

I will also spend 2021 being grateful that I made it through 2020 and appreciating even the smallest personal wins for myself and those around me because we made it!

Year End Financial Wrap Up

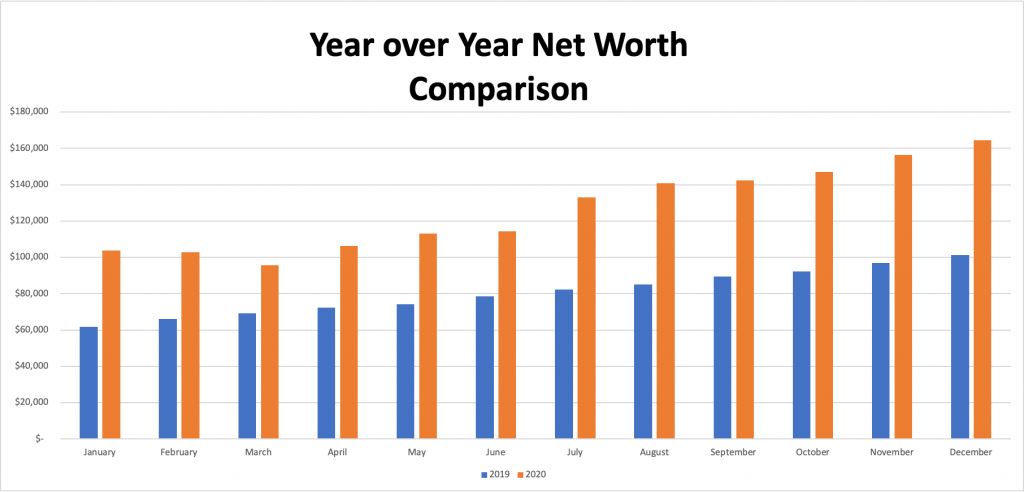

Time for the 2020 Financial review. Did I hit the coveted $200,000 mark? Drum roll! The answer is no. But it was still a great year for me, financially. My net worth increased 62.2% year-over-year. Check out my YOY net worth comparison below:

It goes to show even if you don’t think you’re making a lot progress or the progress is not fast enough for you, just take a step back and look at where you started. I guarantee you’ll surprise yourself and marvel at how much you managed to accomplish. It also makes me crazy to think what would my net worth be if I never started down the FIRE path?

I had hoped to reach $178,000 by this point but if things don’t go any crazier, I should get there some time in the first quarter of 2021. The next milestone that I’m celebrating is $200,000. Most would say the next milestone should be the one and only $250,000 mark. Just saying a quarter of a million dollars sounds amazing. But if $100,000 is such a big deal how can $200,000 not be celebrated?

I’ll be taking the advice of Mr. Steve Harvey, “Don’t get tricky with it!” and I’ll just continue to do the same things that allowed me to reach the first $100,000. My only job at this point is to rinse and repeat knowing that compounding is working quietly behind the scenes and growing more powerful with each passing month.

The Compound Effect is Real!

I mentioned the power of compounding after $100,000. I shared that compounding is the reason it takes less and less time to acquire each consecutive $100,000. I certainly believed it when I read it but to actually see it playing out with my own money is mind blowing.

The reason it takes less and less time is because the dividends and the interest that you reinvest start to become substantial. On average it takes approximately 7.8 years to save your first $100,000. And that’s because the returns on your money don’t amount to very much prior to having $100,000. While saving your first $100,000, the only real growth will come from the amount of money you actually save. But after the first $100,000 dividends, interest and compounding start picking up steam and instead of it taking you another 7.8 years to save your second $100,000, it will now only take you approximately 5.1 years. These numbers are based on a $10,000 annual savings rate.

If things go moderately according to plan, I’m on pace to reach $200,000 in June 2021. That means it would have taken me 1.6 years to save the second $100,00. That is less than half the time it took me to reach the first $100,000. That’s compounding at its finest!

December 2020 Net Worth Update

Cash Accounts

Checking $ 500.00 (no change)

Savings $ 5, 250.00 (+$200)

Business $ 26,753.00 (+$1,753)

MM/E Fund $ 27,500.00 (+$643)

Taxable Investment Accounts

Ally Brokerage $ 26,538.00 (+$2,349)

Investing MM $ 150.00 (+$100)

Vanguard $ 2,562.00 (+$266)

Acorns $ 1,973 ($252)

Tax Advantage/Retirement

Bonds $ 20,025.00 (+$283)

Traditional IRA $ 41, 581.00 (+$540)

$164,430.00

Liabilities: Credit Cards: $0.00

- Credit Card: Paid in full every month

- Checking: No changes

- Savings (P to P): With this account almost fully funded ($5,500 is the goal), I will no longer be putting money into it outside of the automatic $25 that keeps the account free of charge. I plan to allocate money that once landed here into a crypto account

- Traditional IRA: Very happy with this account will keep doing more of the same which, is buying more shares of solid dividend growth companies

- Business Account: This account is now serving as a back-up for tax season

- The E/Fund: Interest rates continue to drop and so any growth in the 2021 will the result of my saving which I increased the for the new year

- Ally (taxable): Still adding to my Apple position and I’ve also added 3M for the New Year

Remember, it is a fight to build wealth no matter where you are in the process. Everything around us conspires to take money out of our hands. But you must fight the good fight. Continue to save, invest, and grow your net worth even when it seems impossible. Save your pennies (copper) until they become dollars (cotton).

I hope all your dreams come true, HAPPY NEW YEAR!