Is it too late to wish you all a Happy New Year? Like everyone reading this, I’ve been busy but I couldn’t wait another day to post my final net worth update for 2019. It was a bumpy ride at times and goals were often blurred by various situations throughout the year. But I managed to pull through and get back on track. Getting back on track was never easy. But my decision to automate my saving and investing early on, has been a big part of my success.

I’m always going to bring it back to the basics. If you are going to build wealth you must automate the process. Especially, if you intend to make consistent progress. This is not to say you won’t have emergencies. I certainly had to cancel a few of my automatic deposits in the first half of the year.

That said, when the following month rolled around and I noticed extra money in my account, it felt strange, like the money didn’t belong to me and I quickly turned the automatic deposit back on. You should also know, that I was never able to make up for the automatic-deposits that I had to skip. My intentions were to put in a little extra every month to make up for those missed deposits but it just never happened. Looking back, if I had put that little extra on automatic it would have made up for the missed deposits and my account balance would be higher today.

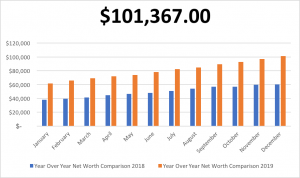

I’m going to miss this $100K milestone. The challenge and adrenaline rush I got from the pursuit of $100K is indescribable. I was pumped the entire year. I worked hard to earn as much as possible and keep my spending in check. I was hyper-focused for long stretches at a time and those stretches helped put me over the top.

So, my question is: Will it all be downhill from here? The next big money milestone according to the financial community is $250,000. However, I plan to make my next big milestone $200,000, simply because I haven’t found much of anything on the FIRE blogs or vlogs about the journey from $100K to $200K. Does this leg of the journey not deserve the same attention? I believe it does and I plan to tell you all about it.

Charlie Munger says, “Once you have your first $100,000 you can take your foot off the gas a little.” But that’s not my plan. Peddle to the metal is how I’m approaching the next $100K.

Mathematically speaking, compound interest (even if it’s small) means, it’s going to take me less time to reach the second $100,000. Zach, at FourPillarFreedom, does an amazing job breaking down why it takes less and less time to save every consecutive $100,000. It took me two years and nine months to reach the first $100K. However, because I bought a house during that time, I don’t think two years and nine months is very accurate. This is why tracking my progress on the way to my second $100K is important to me.

If you didn’t know it, my FIRE (financial independence/retire early) journey doubles as my happy/fun time (nerd!). I was literally on a magical high from June to December as I closed in on the first $100k goal.

I don’t expect the journey to my second $100k to be nearly as exciting as the first. I compare it to the first born in the family. Everyone dotes on the first baby and the parents are super protective. Then when the second baby comes along, of course, you love and care for baby No. 2, but the excitement and energy around that baby just doesn’t compare to the excitement around baby No. 1. (I want to apologize in advance if this truth about birth order is a sore spot for you second and third babies).

Okay, enough of me comparing financial milestones to babies. Time for the net worth update:

December 2019 Net Worth Update

Cash Accounts

Checking $ 500.00 (no change)

Savings $ 4,325.00 (+ $25)

Business $ 8,932.00 (+$896)

MM/E Fund $ 15,606.00 (+$472)

Taxable Investment Accounts

Ally Brokerage $ 16,354.00 (+$1,216)

Investing MM $ 28.00 (-$330)

Vanguard $ 1,068.00 (+$127)

Acorns $ 844 (+94)

Tax Advantage/Retirement

Bonds $ 17,034.00 (+$223)

SEP IRA $ 13,587.00 (+$675)

Traditional IRA $ 23,089.00 (+$965)

$101,367.00

Liabilities:

Credit Card: $580.00

- Checking: All savings/bills are automatically deducted from this account. Any money left over after deductions is sent to the emergency fund.

- Savings (P to P): This account has been going strong. The only money going is a $25 automatic deposit that allows my checking account to be free.

- SEP IRA: This account generated $256.61 in dividends for 2019

- Traditional IRA: This account received $504.75 in dividends for 2019

- Business Account: This account is now at $10,000 and I need to put this money to work ASAP.

- The E/Fund: I haven’t had any reason to hit up the emergency fund. It continues to grow at a modest pace.

- Stocks (taxable): I finished the year with 12 stocks, which generated $447.67 in dividends

- Bonds: The new bond rates went into effect on last month, the interest rate that I’m receiving on all new purchases (I-bonds) now 2.22% This is still way above what most major banks are offering.

- Ally Investment money: This money is always being used to buy dividend paying stocks.

- CC debt: Holiday spending was up but not out of control. The balance will be paid in full at the end of the month.

The $100k net worth was achieved. It took approximately two years and nine months to do this and that includes the purchase of a home, which set me back quite a bit. I started small and just kept my head down. I didn’t care how small my paycheck was I just knew I was paying myself first. I treated any income I received as an opportunity to inch toward my goal.

What do I have in store for the New Year? Back in December, I raised a few of my automatic deposits to help me reach my short-term net worth goal and I plan to step up my effort toward creating an additional stream of income. If you are just starting out on your journey to improve finances, know that it is going to be the best thing you ever did for yourself. I also want you to remember it takes time so enjoy the journey.

It is a fight to build wealth no matter where you are in the process. Everything around us conspires to take money out of our hands. But you must fight the good fight. Continue to save, invest, and grow your net worth even when it seems impossible. Save your pennies (copper) until they become dollars (cotton).