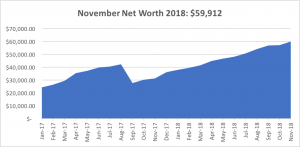

November was a big month for me because I was determined to cross over the big 60-grand net worth mark. But I had a run in with a couple of net worth monsters. First, the market did what the market does and went crazy all month before coming back in the last couple of days, so I still had a shot at reaching my goal.

But then out of nowhere on November 20, and on November 27, I had two friends ask to borrow money. Here’s the thing, if you read this blog you know loaning money gives me anxiety. Every time I loan money I need to reconcile with not getting that money back and then I need to emotionally reconcile and decide that even if I never get paid back I’m going to continue treating the person well.

It takes me a couple of days to work through it all, but once I do I’m good. It was a real shock to my system that after recovering from the first loan, there was now another person asking to borrow money. WTF?! If the two friends knew each other, I’d have sworn they planned it. But I was gracious and loaned the money without question.

As of today, December 9, only one of the friends has paid me back in full. The other person I haven’t heard from. But I’ll certainly keep you posted.

On borrowing money, the last time I borrowed money from someone I was just out of college and I still remember how uncomfortable I felt until I paid the money back. I’ve also been on the other side and have friends that have never paid me back. I’m still okay friends with that person. On the bright side, that person has never asked to borrow a dime from me since. And If they tried to ask I would feel comfortable saying, “Hell no!”

Okay time for the net worth update:

November 2018 Net Worth Update

Assets

Cash Accounts

Checking $ 500.00

Savings $ 4,000.00

Business $ 3,526.00

MM/E Fund $ 8,825.24

Taxable Investment Accounts

SEP IRA $ 8,173.06

Traditional IRA $ 13,931.84

Bonds $12,763.00

Tax Advantage/Retirement

Investing MM $ 151.00

Ally Brokerage $ 7,848.28

Vanguard $ 194.26

$59,912.68

Liabilities:

Credit Card: $0.00 @

- Checking: This account has been very stable over the last few months. I haven’t had to transfer any money to make up for over spending. Money for bills has been going in and coming out on schedule. The current $500 is spoken for and will be totally depleted the day before I get paid.

- SEP IRA: Continues to get hit hard. It was well over $8,400 a couple of times this month. Then the market dropped and it hovered around $7,900 until the market soared the last two days in November taking it back over $8K.

- Traditional IRA: For three straight months, I’ve watched my monthly deposit bring the balance well over $14,000 only to drop back into the mid-$13,000 range. On the bright side, the number of shares that I have continue to grow and lately I’m paying a lot less for those shares.

- The E/Fund: I haven’t had any reason to hit up the old emergency fund and with the savings account almost fully funded I should be able to handle most surprise expenses without touching the E-Fund.

- Stocks (taxable): This account has held up well in the market turbulence. I reached a new personal best with dividends and will post a full dividend update shortly.

- Bonds: This account is doing great and kicks out almost $25-a-month in interest with my latest purchases earning 2.83% interest and older bonds earning 2.52%

- Ally Investment money: My goal for half the year has been to maintain a $1,000 minimum so that I’m able to really take advantage of drops in the market. Unfortunately, I have no self-control and every time my balance hits $300, I’m looking to buy stock. I will do a better job of building this account up in the new year.

- Business account: This account is supposed to be a lot further along because I have hopes of purchasing an investment property. This is the money that I used to help a couple of friends out this month.

- Credit card debt: Currently stands at ZERO. I’m not a Dave Ramsey follower per se, but I believe paying off consumer debt is Baby Step #2. If you’re on top of your financial game with the hope of being financially independent, you will have to eliminate all credit card debt. There is no getting around it. There is no downside to getting rid of all your credit card debt. I’m able to save and invest a little more now and my credit score is through the roof.

It is a fight to build wealth no matter where you are in the process. Everything around us conspires to take money out of our hands. But you must fight the good fight. Continue to save, invest and grow your net worth even when it seems impossible. Save your pennies (copper) until they become dollars (cotton).