I did it! I bought a new home in one of the tightest, most competitive and most expensive markets (in recent history). Why? Because home is where my heart is. What did this major purchase do to my finances? You’ll have to read all the way to the end to find out. I am sharing all my thoughts, where my net worth is right now, how much debt I suddenly have and my plan to start rebuilding my finances.

The Search

I began a very passive search for a new home more than a year ago. It was a passive search because I love where I currently live. Not having to rush from my current residence for any reason allowed me to decide on two things. First, I would not settle. This meant if the things I desired in my new home resulted in 10 boxes to check, then 10 boxes would have to be checked. Second, I would not be a part of a bidding war of any kind even if the home in question checked all 10 of my boxes.

Armed with those two rules for my home search my journey began and ended with me entering a contract in June and closing on my new home in July. Was I nervous? Yes! Did I have doubts about leaving a 2% mortgage behind? Absolutely! That said, I decided money is indeed a tool and if I’m not using it to make my dreams come true, then what’s the point?

Financial Milestones

Full disclosure: It’s tough to spend when you’ve been saving and knocking out financial milestones like Mike Tyson in his prime. The financial milestones I reached over the last couple of years were hard-fought. And the idea of taking a self-inflicted step backward was one that I had to reconcile with over and over before deciding to move forward with the purchase.

FOMO

Once the decision to move forward was made. I had a lot of selling and gathering of funds to do. It was during the selling and gathering stage that I developed a severe case of FOMO. Every time I sold something, the market would go up. All I could think about was the growth, dividends and compounding that I was missing out on with each click of a button. “Forever to build, a moment to tear down” was suddenly on repeat in my mind.

After the FOMO passed, I compulsively checked my accounts wishing the closing day would come just so I would have a clear picture of where my finances stood. I wanted to know where the all-important net worth would stand when this financial upheaval finally ended. Well, to my surprise when I finally closed on the property and the dust settled, I still didn’t have a clear picture of my finances. Why? Because I was suddenly spending money like the Wolf of Wall Street.

Lifestyle Creep

If you’re a financial nerd, part of the FIRE (Financial Independence/Retire Early ) movement, or just casually interested in building and growing wealth then you already know that the No. 1 enemy of your financial goals is lifestyle creep. What is lifestyle creep? It is essentially raising your lifestyle standards to match every raise and bonus that you receive. This means the gap between your bills and expenses never increases.

The gap is the sweet spot in your finances. The bigger the gap between your income and expenses the more you are able to save and invest. If you allow the gap to grow wide enough it allows you to reach goals like maxing out your 401K, having a fully funded emergency fund, or purchasing a new home.

If the gap never has a chance to grow because you always need a newer version of everything you have, it will take a lot longer for you to reach your financial goals…if you ever reach them at all.

While this home is certainly a lifestyle upgrade, I don’t think it’s lifestyle creep because I reached several goals that were very important to me over the years. What were some of those goals? Maxing out my 401K, maxing out my IRA, a one-year emergency fund, a mini emergency fund, and no credit card debt. Check, check and check.

The purchase of this home has not stopped my ability to max out my 401k, or my IRA (I no longer qualify so it goes to my brokerage account). What it has done is reduced my emergency fund by half, completely eliminated my mini-emergency fund, and created credit card debt. All of this will be fixed in time. Eventually, when enough time passes I will have restored the emergency funds and eliminated the debt.

The Assessment

While my spending has not ceased entirely, it has slowed down. I won’t be selling any more stocks, I won’t be selling any more bonds, and since I used all the liquid cash in my emergency fund that leaves me with only CDs, none of which will mature before March of 2024. The once fully funded mini-emergency fund of $7,500 held at my brick-and-mortar bank was the first to go. The account is currently below the minimum balance needed to not incur a fee. The result of my early assessment is that I’m officially cash poor.

The last part of my financial assessment was debt. As it stands, I have put $34,000 of necessary repairs and updates for the new house on a zero-percent credit card. I added the monthly payment obligation to my automatic bill payment list. A list that is quite long.

The Plan

My current financial situation is code blue. That might seem an exaggeration to most but it leans accurate for me, The first serious issue that I plan to tackle is my lack of liquidity. Guilty of holding too much cash in the past I’ve gone from one extreme to the other. With no time to waste, my plan of action was to create a new temporary budget. As someone who tends to hoard cash, I find the lack of liquidity much more disturbing than the debt. So, the new budget makes my liquidity issue priority one.

The new budget had me lower the amount going toward investment accounts, which allows me to throw a little extra into the mini-E-fund. The goal is to get this account as close as possible to being fully funded by December, which is when I plan to reassess my finances and create another new temporary budget.

As for investing, I’m almost done reseeding all the positions that I sold out of to purchase the real estate. That means I have at least one share of everything that I sold off back in my portfolio. The automatic deposit into my brokerage account is now just enough to buy a few shares of something every week because consistency is key when building wealth or anything but since this is a money blog.

The Net Worth Update

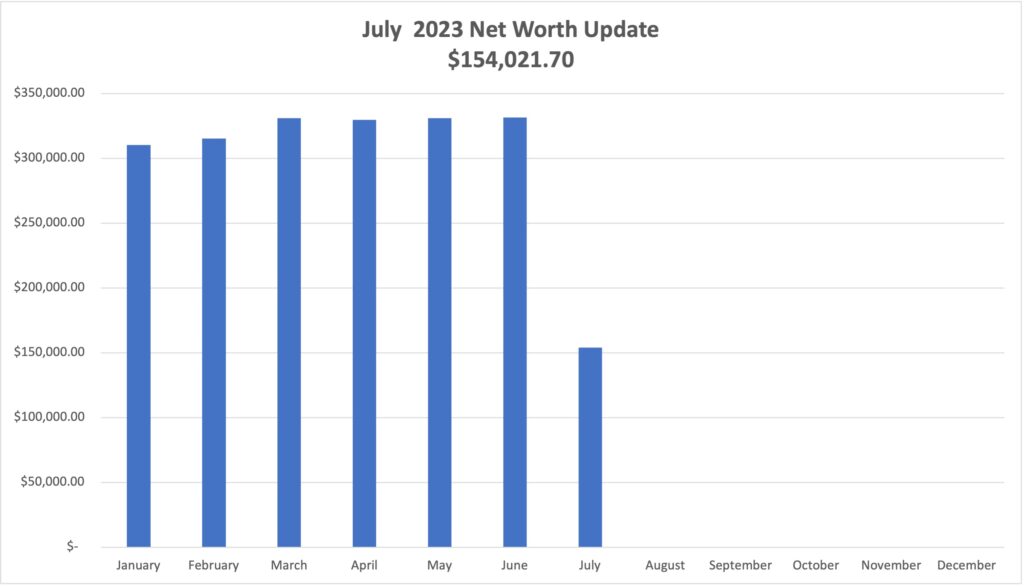

Okay, time to see where the purchase of a new home left my net worth at the end of July. Drum roll, please!

Did you gasp? I certainly did. And that’s because the last time I purchased a home it took nine months to get back to the net worth I had before the purchase. This time, according to my records, it could take up to 2.6 years to pick up where I left off before this purchase. That said, I’ve never felt more up for the challenge to dig in and reach my next milestone of $200K all over again.

My trusted records also show it took me eight months to go from $156,313 to $202,866 the first time. That means by March 2024, I could have a $200K net worth again. Also, I noticed that when I crossed the $200K milestone the first time, I didn’t have as much dividend and interest income as I have now. This will definitely put some wind in my sails. I look forward to seeing where my net worth lands in March 2024.

For some added accountability, I’ll be isolating the mini-e-fund balance and showing it here monthly until it’s fully funded. Also, I have just over a year to pay off the debt currently at zero percent. If I still have the debt when it is no longer interest-free I will begin tracking the balance here.

Goal: $7,500

- Mini-E-fund balance as of July 31st: $325.

I hope you enjoyed this update…

Remember, it is a fight to build wealth no matter where you are in the process. Everything around us conspires to take money out of our hands. But you must fight the good fight. Continue to save, invest, and grow your net worth even when it seems impossible. Save your pennies (copper) until they become dollars (cotton).