President Joe Biden recently debuted a new backup student loan forgiveness plan after the recent Supreme Court ruling that struck down his original proposed program.

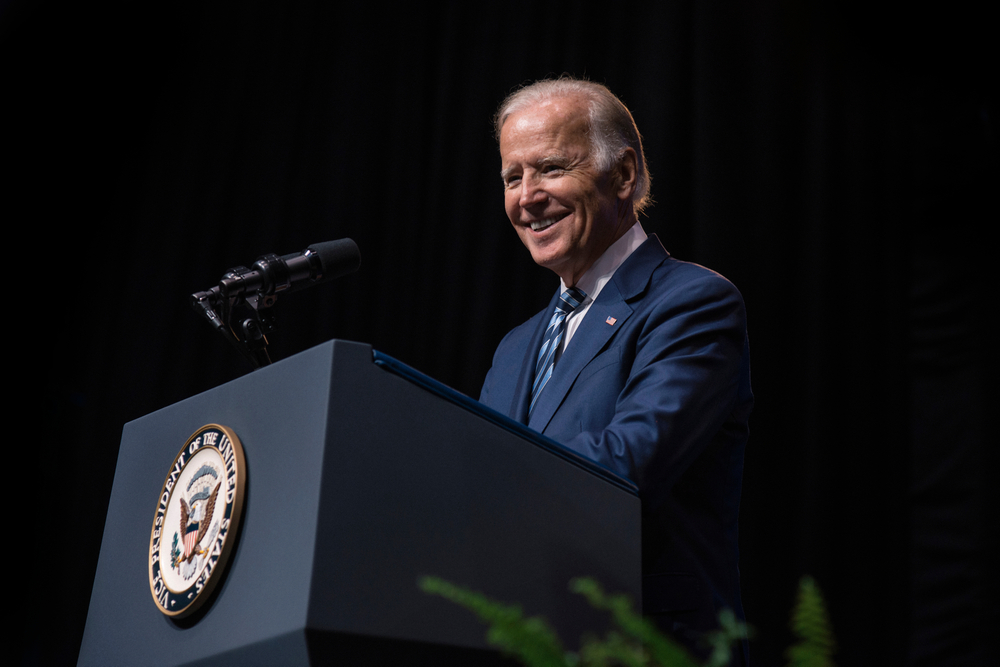

Speaking to the press on Friday, the president highlighted new actions being taken to provide support for those who have taken out student loans.

Outlining his new plan, President Biden said that, as student loan repayments resume on Oct 1, the White House and the Department of Education will begin a 12-month “on-ramp repayment plan.”

According to the official fact sheet, the plan will protect those who are vulnerable to missing payments.

If a payment for a student loan is missed, the borrower will be safe from penalties from credit bureaus, being referred to debt collectors and from falling into default and delinquency, according to remarks by the President.

The Biden-Harris administration also officially announced that they’ve finalized their Saving on a Valuable Education, or SAVE, plan. This expected payment plan will make loans more affordable for borrowers, vowing to save those who take out a loan a minimum of $1,000 per year. As part of the package, the SAVE plan proposes that, for borrowers of undergraduate loans, the amount owed should be halved with a new five percent of discretionary income due instead of the standard ten percent.

The announcement of the backup plan comes after the Supreme Court struck down the Biden-Harris Administration’s original student loan plan. In an official statement, President Biden denounced the ruling, pointing out the “hypocrisy of Republican elected officials” while vowing to continue the fight for students.

“My Administration’s student debt relief plan would have been the lifeline tens of millions of hard working Americans needed as they try to recover from a once-in-a-century pandemic,” said President Biden in his remarks.”Nearly 90 percent of the relief from our plan would have gone to borrowers making less than $75,000 a year, and none of it would have gone to people making more than $125,000. It would have been life-changing for millions of Americans and their families.”

The latest ruling against the administration’s plan comes alongside a series of decisions that have pushed the conservative agenda. Along with allowing discrimination against the LGBTQ+ community, the Supreme Court recently ruled to end affirmative action.

First reported on Thursday, the Supreme Court’s decision prohibits colleges from using the policies set to increase representation amongst students that are accepted.

With the new ruling, an immediate drop in the admissions process is expected, diminishing BIPOC representation for students and educational diversity. The decision is expected to alter over 40 years of policies that have been implemented to address racial inequities in higher education.

Experts point to the nine states that have already previously banned affirmative action as a point of reference for what the future might look like.

According to the New York Times, before the ban of affirmative action in California, Black students made up seven percent of the student body at colleges such as UCLA. After the ban, the percentage decreased significantly, dropping to less than four percent in the span of two years.

Following the announcement, many government officials expressed their disapproval, including Justice Ketanji Brown.

“With let-them-eat-cake obliviousness, today, the majority pulls the ripcord and announces colorblindness for all’ by legal fiat,” wrote Justice Brown in her dissent. “But deeming race irrelevant in law does not make it so in life. No one benefits from ignorance.”

“Although formal race linked legal barriers are gone, race still matters to the lived experiences of all Americans in innumerable ways, and today’s ruling makes things worse, not better,” she added.