The One-Year Recap

I won’t bury the lead. My net worth increased by $69,459 in 2021! And that happened with more than a few sharp market declines and not investing as much as I should have.

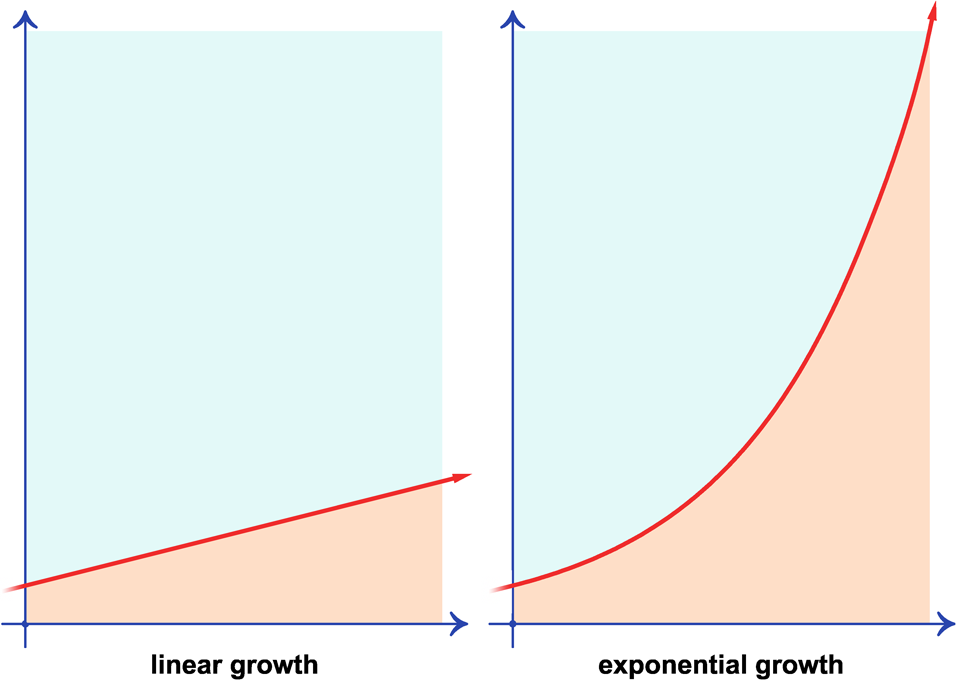

To all of my cash-loving readers, you need to invest if you want to see exponential growth in your portfolio. If your plan is to only save your money in high-yield savings accounts with rates between 0.40% and 0.50%, then you’ve got a long, hard road ahead of you because your wealth is only going to grow linearly. This means the rate at which your money grows is always going to be the same. The speed/rate that your money grows will never significantly increase, especially in the current inflationary and low-interest-rate environment.

To make this crystal clear, there are basically only two ways for your money to grow: linearly and exponentially. With exponential growth, your money quickly gets to the point where it works harder than you ever could. Exponential growth leads to significant wealth accumulation and financial independence. The road to growing your wealth is already a tough journey. Why make it even harder by taking the linear path?

Two Ways For Your Money To Grow

Things That Worked for Me in 2021

Bonds:

What’s old is new again. Bonds have been out of style for about 10 years thanks to a seemingly unstoppable bull market. The lowly bond and its linear behavior is not welcome in most portfolios these days. Afterall, how can a savings bond compete with the exciting promise of overnight riches that NFTs and cryptocurrency offer? For those not betting the house on the metaverse but are instead looking for safe, great returns, savings bonds are the answer.

In November 2021, the United States government gifted those of us who have I-bonds with a 7.12% interest rate (ending April 2022). I managed to take advantage of this inflation-protected asset right from the beginning because I set up an automatic monthly purchase a few years ago, which I increased in November to take full advantage the new rate. But if you still aren’t convinced that I-bonds are a great addition to your portfolio, how about the fact that they pay you interest every month? My interest for the month of December was just shy of $70 ($69.12). I’ll take it!

Stocks, ETFs, Mutual Funds and REITS:

People who self-identify as investors are much more likely to invest in individual stocks, exchange-traded funds, and cryptocurrencies than the broader set of people who only have retirement accounts. – Morningstar

Listen up! The year is 2022, and I think it’s time we all identify as investors. Investing is responsible for the biggest one-year increase to my net worth that I’ve ever experienced. While I wasn’t perfect, I did take consistent, automated action. If you are waiting for the perfect market conditions, the pandemic to end or until you’ve paid off all your debt to start investing, you are making a mistake. Now is the time to invest, not the perfect time because a perfect time doesn’t exist.

If you buy just one share of the total stock market ETF VTI or its mutual fund equivalent VTSAX, then you are an investor. And all it takes at that point is consistency to be a successful investor.

Hint: automate the process and you’ll be consistent. Investing in the stock market is where the exponential magic happens and it’s archaic to not be a part of it.

Cash Became Trash in 2021?:

“Cash is Trash.” This is a statement that I can no longer argue against. That said, I still believe in having a fully-funded emergency fund and then some. Initially, my target was a six-month emergency fund but the pandemic and all the job losses I witnessed, motivated me to want to step that e-fund up to a solid year. So, I’ll continue to build the e-fund in a high-yield savings account throughout 2022.

I currently have a 10-month emergency fund but it should reach 12 months this time next year. At which time, I will redirect the automatic deposits to my brokerage account and speed up the exponential growth that I covet. A little secret: I plan to retire a bit early and I’ll want to have no less than two years of my living expenses in cash. So my plan is to have and maintain half of it now.

Growing My Income in 2021:

I wasn’t nearly as intense and focused on growing my income in 2021 as I was in 2020. In 2021, I worked just as much as I did in 2020, but I developed a routine and things eventually, calmed down around my work life. I knew what clients expected and I mastered meeting those expectations. My earnings will be a little more than last year and that’s what I planned. I didn’t want 2021 to be the relentless grind that 2020 was.

I’m not sure what 2022 will hold regarding additional work but I don’t anticipate anything being added to my plate in the first half of the year. This might sound crazy on a financial blog but the money I earn is more than enough and I’m content (Thank God). I wanted to get to a certain level and now that I’ve reached it, I’m enjoying it. I understand that there are levels 10X, 20X, 1000X greater than where I currently sit economically but I’m truly grateful for where God has allowed me to be right now. In time, I’ll reevaluate my next level and what it will take to get there.

(Lifestyle) Creep, Creep, Creep:

There was absolutely no lifestyle creep for me in 2021. As a matter of fact, my bills have actually decreased by (getting rid a few silly spending habits and subscriptions). Meanwhile, my income has steadily increased over the past three years.

When I bought my home I was at the very top of the debt-to-income ratio, somewhere around 43% (not smart but I had to have this house). The mortgage company didn’t want to approve me and a lot of things had to happen to get the deal done.

Today, my debt-to-income ratio sits at or just below 20% because even though my income increased, my debt and my spending habits have not. I don’t live on a budget but I also don’t have a lot of wants. Spending less than you earn, and saving and investing the difference is the formula for building wealth. But if you decide to increase your income and manage to keep your expenses the same as they were…well, you’ve just supercharged your ability to build wealth. And this, my friends, was a major contributor to my net worth increasing by $69,459 in 2021.

I can’t predict what the markets will do next year or what condition the country will be in but I can predict and control my actions. That means in 2022, I’ll be doing more of everything I did in 2021.

Okay, time for the final net worth update of 2021:

Cash Accounts

Checking $500.00 (no change)

Savings $6,306.00 (+$106)

Business $37,326.00 (+$1,306)

MM/E Fund $35,374.00 (+$622)

Taxable Investment Accounts

Ally Brokerage $44,467.00 (+$2,781)

Investing MM $100.00 (+$100)

Vanguard $10,474.00 (+$4,113)

Tax Advantage/Retirement

SEP IRA $19,778.00 (+993)

Bonds $22,921.00 (+$500)

Traditional IRA $53,861.00 (+$2,231)

$236,623.00

Liabilities: Credit Cards: $2,900 @ 0.00% until 6/2023

December was full of great surprises like a receiving a great bonus from my W-2 employer and watching the stock market do a reverse dunk on all the naysayers. Yes! The market still has room to run.

- Credit Card: Geesh! I knew it was going to be bad but $3,000 dollars is more than I expected. I didn’t have to apply for a zero-percent card offer to charge this $3,000. I’ve been grandfathered into a semi-permanent line of credit that has always been 0% for me. The only thing I’ve do to earn this is maintain excellent credit. This line of credit was available to me long before I ever thought I could be a preferred customer.

- Checking: Putting the exact amount I need to cover my bills and not a dime more has worked out really well for me. I haven’t had a single over draft in the last 3 years since I started doing this and will probably move that $500 buffer that I was so desperate to have.

- Savings (P to P): I paid a small credit card bill out of this account and decided not pay myself back. I tried not to add any money to this account outside of the $25 that is automatically deducted that keeps the account free. My instinct is to always squirrel away money. One day at time.

- Traditional IRA: I bought another share of Microsoft this month and I will add VNQ in January. VNQ will be the only new addition in 2022.

- Business Account: This account is growing again but I like having a buffer for tax season.

- The E/Fund: This account is very close to being fully funded. An interest rate hike of significance would really help to speed things up.

- (taxable)brokerage: This account made an incredible rebound. Looking forward to crossing the $50K mark in the first quarter of 2022.

Remember, it is a fight to build wealth no matter where you are in the process. Everything around us conspires to take money out of our hands. But you must fight the good fight. Continue to save, invest, and grow your net worth even when it seems impossible. Save your pennies (copper) until they become dollars (cotton

Note: The information in this blog is for entertainment purposes only and should not be considered investment advice. Please consult a licensed professional for investment advice.